In the post-pandemic period, global energy markets have taken the path of developing new application formats and systems by trying to take measures against resonances. The aim here is to ensure continuity by developing mechanisms against unpredictable pricing and minimizing price fluctuations. Developed countries have undertaken a number of energy reforms to make their markets more controlled and predictable.[1]

On the other hand, developing countries, particularly Turkey, have implemented the concept of “energy efficiency” due to their lack of market dominance.[2] In fact, involuntary fluctuations in the price of raw materials purchased from one market and unforeseen crises also affect global oil prices. Following the Russia-Ukraine War, the onset of the Hamas-Israel conflict led to a partial increase in oil prices, particularly natural gas prices, followed by a decline in prices contrary to expectations.

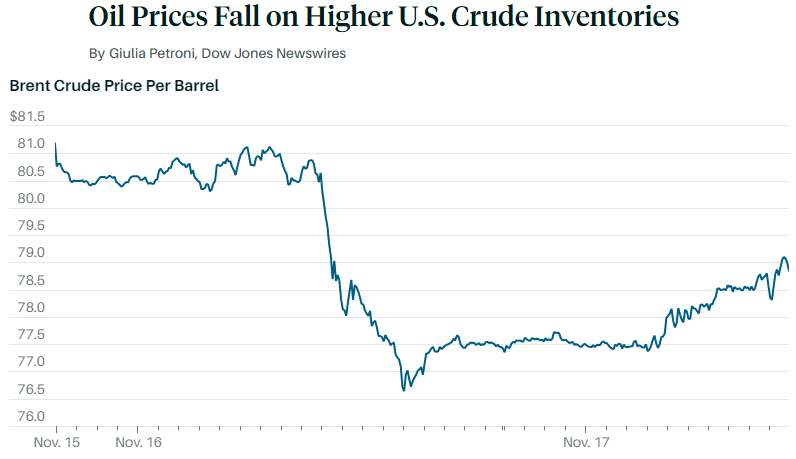

Oil prices fell around 5 percent to a four-month low on Thursday, November 16, 2023, due to economic concerns in the United States of America (USA) and China. Investors experienced a decline due to concerns about global oil demand after weak data from the United States and Asia. Brent futures ended the day down 4.6% at a low of $77.42 per barrel. U.S.A. West Texas Intermediate (WTI) crude also declined, falling $3.76, or 4.9%, to $72.90 per barrel. Both Brent and WTI had earlier declined to $76.60 and $72.16 respectively, trading at their lowest levels since July 7, 2023.[3]

Table 1: Brent Oil Prices for November 15-17, 2023.[4]

The number of Americans filing new unemployment applications rose to a three-month high last week, indicating that labor market conditions are still not easing. This report comes on the heels of other data showing that US retail sales in October declined for the first time in seven months, with a decline in motor vehicle purchases and spending on hobbies for the first time. This further reinforced expectations that demand was slowing at the beginning of the fourth quarter and led to expectations that the Federal Reserve had completed an interest rate hike. The Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) have predicted a supply crunch in the fourth quarter. But U.S.A. data have shown that inventories are plentiful.

On the other hand, an expected slowdown in China’s oil refinery processing speed also gave investors pause for thought. Industrial fuel demand weakened and refining margins narrowed in October. However, as the Israeli-Hamas conflict continued to escalate in Gaza, the US said it would impose oil sanctions against Iran, a longtime supporter of Hamas.[5] According to EIA data, American crude oil stocks rose by 3.59 million barrels to 439.4 million barrels in the second week of November, the highest level since August. Moreover, the US decision to impose oil sanctions against Iran led to continued pressure on prices.

According to information from the National Data Agency, China’s crude oil refinery processing rate in October fell by 2.8% to 15.1 million barrels per day equivalent production, from September’s record production level. This indicates a slowdown in demand from the world’s second largest economy.[6] Phil Flynn, Oil Expert from Price Futures Group, made the following statement:[7]

“It serves the theory of decreasing demand by combining slowing industrial production with increasing supply. Prices are having a hard time finding support right now.”

In the post-pandemic period, the reopening of the Chinese economy and increasing demands, the highest oil production in the history of the U.S.A., and the increase in production capacities of Canada, Brazil and Guyana in support of this, have been able to provide some support against uncertainties and crises. On the other hand, OPEC attributed the recent price decline to speculators and considered negative comments as exaggerated. Noting that China’s crude oil imports increased by 11.4 million barrels per day in October, OPEC also stated that U.S.A. economic growth was strong in the third quarter and the International Monetary Fund predicted that China’s economy will grow by 5.4% this year.

Following the faster-than-expected slowdown in inflation in the U.S.A., according to data released yesterday, the Producer Price Index (PPI) also recorded its largest monthly decline since April 2020 with 0.5% in October, while the annual increase was realized below expectations with 1.3%.

Analysts stated that the pricing in the money markets was almost certain that the FED would leave interest rates unchanged at its December meeting, while forecasts that the bank would start cutting interest rates as of June next year gained strength. While the statements of FED officials were in the focus of investors, San Francisco Fed President Mary Daly emphasized that the latest economic data showing a further slowdown in inflation was “encouraging.”

Expectations of recession in China put pressure on prices. In China, the world’s largest oil importer and the second largest oil consumer, the decline in house prices showed that negative signals in the economy continued, raising concerns that oil demand in the country would also weaken. However, positive forecasts for the Chinese economy and oil demand outlook in the latest reports of OPEC and EIA alleviated these concerns and prevented a further decline in prices. Technically, it is stated that the range of 81.33 to 81.57 dollars can be followed as resistance and the range of 80.01 to 79.59 dollars as support zone in Brent oil.[8]

[1] “AB’de Elektrik Reformu.”, Dünya, https://www.dunya.com/kose-yazisi/abde-elektrik-reformu/696635, (Erişim Tarihi: 21.06.2023)

[2] “Enerji Verimliliği”, T.C. Enerji ve Tabii Kaynaklar Bakanlığı, https://enerji.gov.tr/enerji-verimliligi, (Erişim Tarihi: 21.06.2023)

[3] “Oil Prices Slump To 4-Month Low On U.S., Chinese Economic Concerns”, Reuters, https://www.reuters.com/business/energy/oil-prices-dip-us-crude-build-asia-demand-worries-2023-11-16/, (Erişim Tarihi: 17.11.2023)

[4] “Oil Prices Fall on Higher U.S. Crude Inventories”, Barron’s, https://www.barrons.com/livecoverage/stock-market-today-111623/card/oil-prices-fall-on-higher-u-s-crude-inventories-vWeXNTXMMnAQXdwpFuIy, (Erişim Tarihi: 16.11.2023).

[5] Aynı yer.

[6] “U.S. crude oil prices fall 5% as supply grows amid demand worries”, CNBC, https://www.cnbc.com/2023/11/16/us-crude-prices-fall-nearly-4percent-as-inventories-rise-.html, (Erişim Tarihi: 16.11.2023).

[7] Aynı yer.

[8] “Brent Petrolün Varil Fiyatı 80,77 Dolar”, AA, https://t.ly/L-Yov, (Erişim Tarihi: 16.11.2023)