Current conflicts continue to affect oil and gas markets fluctuating under the pressure of a weak global economy. Although crude oil has caused some price fluctuations, natural gas prices have recently absorbed most impacts as a result of conflicts in the Middle East. Natural gas prices rose 15% in October and experienced a 40% rise in the last eight months. Since the geopolitical conflict takes place against the background of a weak global economy, the question of how the gas markets will go, especially in Europe, is inevitable. In the event of a full-scale war, according to Bloomberg Economy’s forecast, the global economy could go into recession with a loss of $1 trillion, and oil prices could reach $150 per barrel. This can naturally cause the gas markets to rise even more. [1]

Eurozone economy may slow down in natural gas demand. The possibility that natural gas prices will not remain at high levels for a long time is still among the possibilities due to the slowdown of the global economy and especially the Eurozone economy. Business activity in Germany, the largest economy in Europe, contracted for the fourth month in a row. According to the latest PMI (Project Management Institute) data; the manufacturing and service sectors have shown a decline. France, the eurozone’s second-largest economy, also reported a contraction in business activity in October, but showed a slight improvement from its almost three-year low in September.

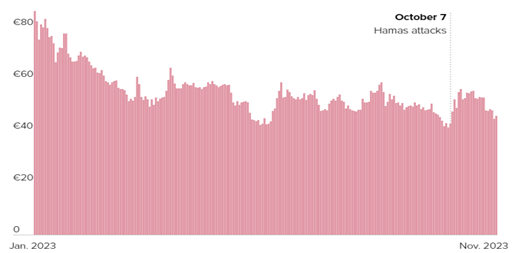

On the other hand, with the start of the Hamas-Israel conflicts, prices suddenly rose when Chevron stopped production in the Tamar area with the decision of the Israeli Government. Even if the Tamar field is not in the capacity to affect gas prices globally, it gains great importance with the production of 7.1-8.5 billion cubic meters per day and the prediction that natural gas cooperation will be made from these areas among the EU’s future plans. As a matter of fact, even if gas production continued from the Leviathan field after the closure of the Tamar field for security reasons, it has not been able to meet the demand until the past weeks. [2]

Table 1. Global Gas Prices (January-November 2023) [3]

If this trend continues, Europe’s largest gas market is expected to contract by more than 25% by the end of the year. A similar trend is seen in other major European gas consumers, such as Italy, the Netherlands and France. Hedge funds have sold 125 billion cubic feet of equivalent gas futures over the past week, with natural gas prices falling another 3% due to a slowdown in demand. However, as the process progresses, we can expect a slight increase in consumption, which indicates a 1% increase in October. This is the first annual increase since the Russian-Ukrainian War began.

Therefore, it is possible that the market will be vulnerable to supply shakes or rather a perceived threat. In addition, European energy markets are expected to experience strong fluctuations that keep observers, traders and analysts afloat due to geopolitical uncertainty. These indicators will help confirm that gas markets will follow a trend similar to the oil markets if the current conflict is limited or if there is no further climb.

Stating that they learned from Russia’s war against Ukraine, EU Energy Commissioner Kadri Simson said, “We are prepared for the congestion in the global oil and diesel market. We strive to build a good understanding of how best to address all our weaknesses and how we can be prepared for any event or urgency,” he said. EU officials have stated in recent weeks that they have held a series of meetings with both old friends such as Norway and rising partners such as Algeria and Nigeria to take precautions in advance against possible cuts. Kadri Simson commented, “After the Gaza crisis emerged, we are facing two conflicts in the European neighborhood.”

The Eastern Mediterranean is an important stage for Europe’s energy security. Because Europe’s energy transformation is still intertwined with geopolitical uncertainties. The conflict in Gaza and, to a lesser extent, Israel’s conflict on the Lebanese border, have a limited impact on the oil markets. Prices have risen with the Israel-Hamas conflict. However, Brent, a key crude oil reference, fell 4.2% in the second week of November, approaching its initial levels and trading at around $81. The impact of the Israel-Hamas conflicts on prices is projected to weaken. [4]

[1] “Europe Energy Crisis: Have Natural Gas Prices Peaked?”, Euronews Business, https://www.euronews.com/business/2023/11/16/europe-energy-crisis-have-natural-gas-prices-peaked, (Date Accesion: 16.11.2023)

[2] “Chevron, İsrail’deki Doğalgaz Tesisinde Üretimi Durdurdu.”, Bloomberg, https://www.bloomberght.com/chevron-israil-deki-dogalgaz-tesisinde-uretimi-durdurdu-2339794, (Date Accesion: 09.10.2023).

[3] “Europe Braces For A Winter Of Two Wars.”, Politico, https://www.politico.eu/article/europe-braces-winter-two-wars-energy-price-gas-oil-electricity-hamas-israel-ukraine-russia/, (Date Accesion: 08.11.2023).

[4] Ibıd..